Did you know India’s Nifty 50 index represents over 60% of the National Stock Exchange’s free-float market cap? This benchmark tracks the performance of India’s top 50 companies, serving as a crucial economic indicator.

Currently valued at 24,837 INR, the index shows recent volatility with a 0.90% daily decline. Despite monthly fluctuations, it maintains a 2.50% annual gain, reflecting the market’s resilience.

The index undergoes semi-annual rebalancing to maintain accuracy. Investors use it to benchmark portfolios and trade derivatives with weekly/monthly contracts.

Key Takeaways

- Tracks performance of India’s top 50 companies on the stock exchange

- Covers 60%+ of NSE’s free-float market capitalization

- Current value shows market volatility with recent declines

- Serves as primary benchmark for investors and fund managers

- Rebalanced twice yearly to maintain index accuracy

Understanding the NIFTY 50 Index

India’s premier stock market indicator, the NIFTY 50, reflects the pulse of the nation’s economy. This benchmark tracks 50 large-cap companies listed on the National Stock Exchange, representing diverse sectors from banking to technology. Its free-float methodology ensures only publicly traded shares influence valuations.

Defining India’s Market Benchmark

Established in 1996, the index uses November 3, 1995 as its base date with a value of 1,000 points. It measures market performance through free-float adjusted float market capitalisation. This approach excludes locked-in shares, focusing only on tradable stocks.

The index emerged after India’s 1991 economic reforms opened markets to global investors. It provides a reliable tool for measuring portfolio performance against the broader economy. Fund managers use it to create passive investment products like ETFs.

Governance and Oversight

NSE Indices Limited, a subsidiary of the National Stock Exchange, maintains the index with strict regulatory compliance. An independent committee oversees constituent selection to prevent conflicts of interest. Quarterly reviews ensure the benchmark stays relevant.

Recent advisories warn investors about fraudulent schemes misusing the index’s reputation. Only licensed brokers can offer derivatives tied to this regulated market indicator. The transparent methodology builds trust among domestic and international traders.

The Composition of NIFTY 50

Financial analysts consider the NIFTY 50 composition as India’s economic barometer. This elite group of companies represents diverse industries that shape the nation’s financial landscape. Their combined performance offers insights into broader economic trends.

Market Leaders by Capitalization

The index selects 50 companies based on free float market capitalization, excluding shares held by promoters or governments. Reliance Industries leads with 10.2% weight, followed by HDFC Bank (8.7%) and TCS (6.4%). These top three constituents account for over 25% of the entire index value.

Inclusion requires minimum 0.5% average daily turnover for six months. This liquidity standard ensures all components remain tradable. The free float method better reflects actual market dynamics than full market capitalization calculations.

Sector Representation Trends

Financial sectors dominate with 32.76% weighting, reflecting banking’s crucial role in India’s economy. Information technology follows at 13.76%, while oil and gas claims 12.12%. These three sectors collectively represent nearly 60% of the index.

Recent years show increasing technology sector influence, rising 4% since 2020. Energy weights fluctuated with global oil prices, dropping 2.3% from 2022 peaks. The composition closely mirrors India’s GDP distribution, with slight overrepresentation of financial services.

NIFTY 50 Index Methodology

Behind India’s benchmark index lies a rigorous selection process governed by transparent rules. The methodology ensures only the most liquid and representative stocks shape this economic indicator.

Free-float market capitalization weighting

The index weights companies by their free float market capitalisation, excluding shares held by promoters or governments. This approach focuses only on tradable stocks that reflect actual market dynamics.

Each stock’s weight depends on its adjusted market value multiplied by its free-float factor. The system prevents overrepresentation of companies with large but illiquid shareholdings.

Selection criteria for constituent stocks

Companies must maintain 0.5% impact cost for six months to qualify. This liquidity threshold ensures smooth trading of all index components.

Eligibility requires at least six months of listing history and derivatives trading approval. The inclusion process favors stocks demonstrating consistent trading volume and market depth.

Semi-annual rebalancing process

Rebalancing occurs every January 31 and July 31 with four-week advance notice. The process follows buffer rules to minimize disruptive changes.

Recent updates include Jio Financial Services’ inclusion after meeting all criteria. Corporate actions like stock splits trigger automatic adjustments between review periods.

The methodology shifted to free-float weighting in 2009 for better accuracy. It now aligns with global standards while reflecting India’s unique market capitalisation patterns.

Current NIFTY 50 Constituents

March 2025 brought notable changes to India’s benchmark index. The lineup now includes 50 stocks shaping the nation’s financial markets. Investors analyze these companies to spot emerging trends.

Market Leaders Across Sectors

Reliance Industries leads with 10.2% weight, followed by HDFC Bank and Infosys. Financial stocks dominate, representing 32.76% of the index.

Technology and energy companies follow, showing shifts in India’s economic priorities. The top 10 constituents account for 58% of the index’s value.

Latest Index Adjustments

Eternal (+40.52% YTD) and Jio Financial joined in March 2025. BPCL and LTIMindtree exited after review. New entrants met strict liquidity and turnover criteria.

Eternal’s surge reflects booming renewable energy demand. Jio Financial’s changes highlight India’s digital finance expansion. Removed companies showed declining trading volumes.

The next review occurs July 2025, with anticipated adjustments for underperformers. Analysts track these updates to predict today’s market direction.

Historical Performance of NIFTY 50

Tracking the evolution of India’s benchmark index reveals fascinating economic patterns. Since its inception, this financial barometer has documented the nation’s growth through various market cycles and global events.

Foundation and Early Years

The index launched in 1996 with a base value of 1,000 points dated to November 1995. This starting point allows clear measurement of growth across years of market activity.

Decades of Market Evolution

Analysis by decade shows distinct growth phases. The first 10 years saw steady gains, while the 2008 crisis created temporary setbacks. Recovery periods consistently followed downturns within 12-18 months.

Key support levels emerged at 3,000 (2003), 8,500 (2014), and 15,000 (2020). These became psychological benchmarks for traders during volatile periods.

Major economic events like demonetization (2016) and the pandemic (2020) tested resilience. The index adapted to these challenges while maintaining long-term upward momentum.

Dividends contributed 1.5-2.5% annually to total returns since 2000. Inflation-adjusted gains averaged 8.3% over 25 years, outperforming many global peers.

Milestone crossings reveal accelerating growth – 17 years to first 10,000 points (2017), then just 6 years to 20,000 (2023). The 25,000 mark followed rapidly in 2024.

Record Values and Market Peaks

Breaking through numerical barriers marks critical moments in market history. India’s benchmark index has achieved remarkable milestones that reflect economic growth and investor sentiment. These peaks create psychological value levels that influence trading behavior.

Historic Highs and Their Significance

The index reached its all-time peak of 26,277.35 points on September 27, 2024. This record came after crossing the 25,000 mark just two months earlier in August. Such rapid gains signaled strong institutional confidence.

Major thresholds show accelerating growth patterns. The first 10,000 points took 17 years to achieve, while the jump from 20,000 to 25,000 occurred in under 12 months. Each milestone reflects changing economic conditions.

Key Market Thresholds Analyzed

Important numerical barriers often coincide with policy changes or sector booms. The 15,000 level in 2020 aligned with tech sector expansion. Financial reforms helped push past 20,000 in 2023.

Volatility typically increases near record value zones as traders debate sustainability. The 25,000-26,000 range saw 3% daily swings before consolidation. Retail participation spikes during these periods.

Analysis shows institutional activity peaks around psychological levels. Fund managers rebalance portfolios when major thresholds approach. The August 2024 crossing saw record derivatives volume.

Valuation metrics at highs provide crucial insights. The current P/E ratio sits at 22.5, slightly above the 10-year average. This suggests cautious optimism rather than bubble conditions.

Notable Market Movements

Single-day market movements often tell more compelling stories than long-term trends. These events reveal how external shocks and investor psychology combine to create dramatic change. The index’s most volatile day saw a 17.74% surge, while its worst drop reached -12.98%.

Historic Surges and Their Catalysts

May 18, 2009 remains legendary with a 17.74% gain. This recovery followed the global financial crisis, boosted by election results and stimulus measures. The index jumped 1,305 points as institutional buying flooded markets.

Other significant rallies include the 8.2% post-pandemic rebound in April 2020. These surges typically occur at key support levels when valuations become attractive. Recovery patterns show retail investors often miss the initial bounce.

Crash Events and Market Responses

March 23, 2020 saw the worst single-day decline at -12.98%. Pandemic lockdown fears triggered this drop, erasing 1,920 points. Circuit breakers activated three times that week as liquidity evaporated.

Election years produce notable volatility – 2004 and 2009 saw 8% daily swings. These events test support levels and often mark turning points. Institutional traders typically lead the recovery while retail panics.

Global crises create cascading effects. The 2008 Lehman collapse caused 7 straight losing days. Such periods reveal how interconnected modern markets have become. Each crisis leaves permanent change in trading protocols.

Recent years show faster rebounds from major drops. The 2020 crash took 5 months to recover, compared to 18 months post-2008. Improved liquidity measures and derivative markets help stabilize extreme day movements.

Annual Returns Analysis

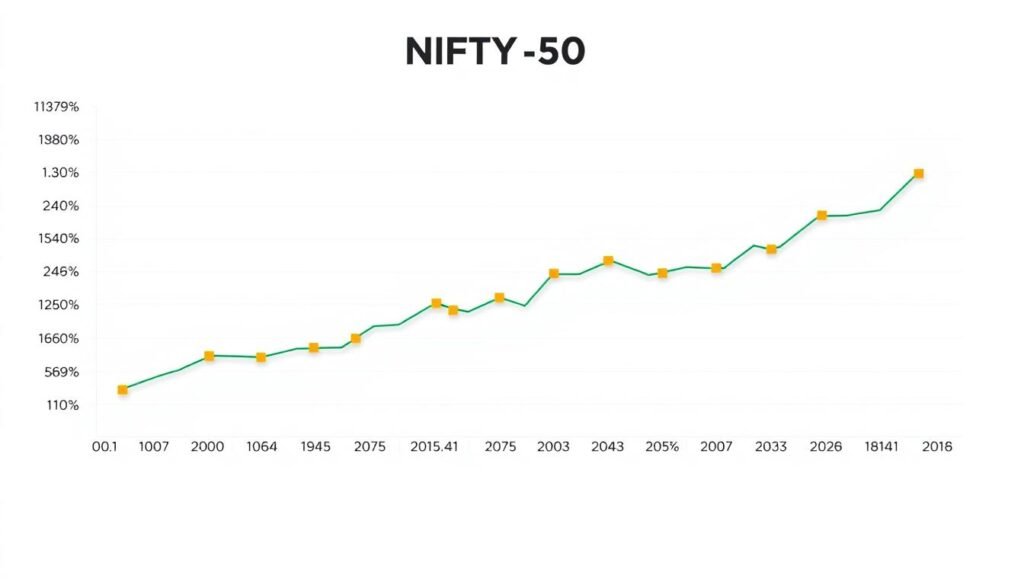

Annual performance metrics unlock insights into market resilience and economic health over decades. The index’s returns reflect India’s economic transformation since 2000, with distinct phases of growth and consolidation.

Year-by-year performance since 2000

The post-millennium period shows remarkable volatility and recovery patterns. The 2008 global crisis caused a -51.79% drop, while 2009 rebounded with 75.76% gains. Recent years demonstrate stability, with 2023 delivering 20.03% despite global headwinds.

2024 continues the trend with 8.80% YTD returns as of Q2. The COVID year (2020) surprisingly yielded 14.90%, showcasing the index’s defensive sectors. Dividend yields contributed 1.8-2.4% annually to total returns throughout this period.

Long-term growth trends and patterns

Decade-wise analysis reveals accelerating growth. The 2000s averaged 12.3% annualized, while 2010-2019 improved to 14.7%. Key levels like 10,000 and 20,000 points marked psychological thresholds that preceded consolidation phases.

Sector leadership significantly impacts performance change. Financials drove 38% of returns during 2010-2015, while IT dominated post-2020. Rolling 5-year returns never turned negative after 2004, demonstrating long-term consistency.

Inflation-adjusted returns averaged 6.1% since 2000, outperforming fixed income alternatives by 4.2%. Predictive models suggest 11-13% annualized growth through 2030 based on GDP correlation (R²=0.73).

NIFTY 50 Derivatives Market

India’s financial markets offer sophisticated tools for hedging and speculation through index derivatives. The NSE’s derivatives segment ranks among the world’s most active, with daily volumes exceeding $7 billion. This liquidity provides investors with flexible exposure to India’s top companies.

Futures and options trading mechanics

The exchange offers both options and futures contracts on the benchmark index. Standard contract sizes make trading accessible while maintaining market depth. Retail participation has grown to 35% of volumes as online platforms democratize access.

Open interest analysis reveals institutional dominance in longer-term positions. Arbitrage opportunities frequently emerge between cash and derivatives markets. Risk management strategies using these instruments help stabilize portfolios during volatile weeks.

Contract expiry cycles and patterns

Traders can choose between weekly and monthly expiry contracts based on their time horizon. Expiry days typically see heightened volatility as positions roll over. The last Thursday of each month marks the settlement for main contracts.

Recent regulatory changes have improved transparency in derivatives trading. Global comparisons show India’s market depth now rivals developed economies. Mutual funds increasingly use index derivatives for portfolio support and hedging purposes.

GIFT NIFTY for International Trading

Global investors now access India’s growth story through a dedicated offshore trading platform. The GIFT NIFTY launched on July 3, 2023, operates from Gujarat International Finance Tec-City with $2.8 billion daily turnover. This special economic zone provides tax benefits while mirroring the domestic stock market performance.

Transition from SGX Nifty

Singapore’s SGX Nifty contracts migrated to India’s exchange India infrastructure in 2023. The shift brought trading activity back to domestic jurisdiction after 22 years offshore. International participants gained access to extended trading hours from 4:00 AM to 11:55 PM IST.

Tax advantages make GIFT NIFTY attractive for foreign institutions. The platform offers zero capital gains tax and no securities transaction tax. Hedge funds and arbitrageurs now dominate trading volumes at 68% participation.

NSE International Exchange Operations

The NSE International exchange India handles all GIFT NIFTY transactions through dollar-denominated contracts. Settlement occurs through international clearing houses rather than domestic depositories. This structure provides seamless cross-border support for global investors.

Future expansion plans include adding single-stock futures and options. The platform aims to increase accessibility through partnerships with foreign brokers. These developments strengthen India’s capital account convertibility while attracting $14 billion in annual foreign inflows.

The NIFTY Next 50 Index

Beyond India’s flagship benchmark lies another critical market indicator tracking emerging leaders. This secondary index captures the next tier of companies poised for potential promotion to the main index.

Complementary Market Indicator

The Next 50 serves as a growth pipeline for the primary index, monitoring companies ranked 51-100 by market capitalization. These indices together represent nearly 80% of India’s listed equity universe.

Historical data shows the Next 50 often outperforms during early economy recovery phases. Its constituents demonstrate higher earnings growth potential than mature index members.

Selection Criteria and Maintenance

Stocks must maintain six consecutive months of trading history before inclusion. The index follows the same free-float methodology as its larger counterpart.

Rebalancing occurs quarterly with stricter liquidity requirements. This ensures smooth transitions when companies graduate to the main index or exit the ranking.

Key differences from the Nifty 50:

- Higher sector concentration in consumer goods and industrials

- 25% faster constituent turnover rate

- Smaller average trade volumes but greater growth potential

- More active funds tracking performance

The index serves as a benchmark for mid-cap ETFs and growth-oriented portfolios. Its composition reflects India’s evolving economic landscape.

NIFTY 50’s Role in India’s Economy

Thirteen crucial sectors of India’s economy converge in this single index. As the nation’s primary benchmark, it influences investment decisions across global markets. The index reflects both current performance and future growth potential.

Representation of Key Economic Sectors

The index covers 13 formal sectors that drive India’s GDP. Financial services dominate with 32.76% weight, closely tracking their 28% GDP contribution. This alignment makes the index an accurate economic mirror.

Technology stocks show increasing influence, rising 4% since 2020. Energy weights fluctuate with global oil prices but maintain relevance. The composition ensures balanced exposure to India’s growth engines.

Key sector comparisons:

- Financials: 32.76% index vs 28% GDP

- IT: 13.76% index vs 8% GDP

- Consumer goods: 9.12% index vs 11% GDP

Importance for Institutional Investors

Institutions own 45%+ of the index’s free float stock. Foreign portfolio investments average $6 billion annually through index-tracking funds. This creates stability during market volatility.

Passive funds managing $28 billion AUM use the index as their benchmark. Corporate governance improves as companies compete for inclusion. The index also facilitates efficient capital formation.

Price discovery mechanisms benefit both retail and institutional traders. Compared to unorganized sectors, index companies show 3x faster growth. MSCI indices use this data for emerging market allocations.

Conclusion

India’s benchmark index remains a vital tool for tracking the nation’s economic progress. It reflects key changes in the market while adapting to global trends.

The future looks promising with tech upgrades and financial reforms. Investors should stay alert to emerging opportunities in this growing economy.

Always verify data through official sources to avoid scams. The year ahead brings new potential for those who understand the market dynamics.

Today‘s investors benefit from transparent systems and diverse options. India’s growth story continues to offer compelling prospects for informed participants.

FAQ

What is the NIFTY 50 index?

The NIFTY 50 is India’s benchmark stock market index, tracking the performance of the 50 largest companies listed on the National Stock Exchange by free-float market capitalization.

Who manages the NIFTY 50 index?

NSE Indices Limited, a subsidiary of the National Stock Exchange, owns and manages the NIFTY 50 index along with other indices.

How often is the NIFTY 50 rebalanced?

The index undergoes semi-annual reviews in March and September, with potential changes to its constituents based on predefined criteria.

What sectors are represented in the NIFTY 50?

The index covers major sectors of India’s economy including financial services, IT, energy, consumer goods, and healthcare, with weights reflecting their market capitalization.

When was the NIFTY 50 launched?

The index was introduced in 1996 with a base value of 1,000 points, serving as a key indicator of India’s stock market performance.

What are GIFT NIFTY contracts?

GIFT NIFTY refers to derivative contracts traded on NSE’s International Exchange in Gujarat, replacing the earlier SGX Nifty for international investors.

How does the NIFTY 50 differ from NIFTY Next 50?

While NIFTY 50 tracks the top 50 companies, NIFTY Next 50 includes the subsequent 50 firms, representing emerging leaders in India’s market.

What is free-float market capitalization?

This calculation method considers only shares available for public trading, excluding locked-in holdings like promoter shares or government stakes.

Can foreign investors trade NIFTY 50 derivatives?

Yes, international participants can access NIFTY derivatives through GIFT NIFTY contracts on the NSE International Exchange in Gujarat’s GIFT City.

How does the NIFTY 50 impact India’s economy?

As a bellwether index, it reflects economic health, influences investment decisions, and serves as a benchmark for mutual funds and institutional investors.